The past year brought some interesting marketing shifts: more spending, tighter ROI, and a clear divide between channels that perform and those that don’t.

We analyzed data from 350+ brands across industries to help you plan smarter. The result was a deep, practical view of where to invest, how to rebalance your media mix, and what separates efficient brands from the rest.

This blog highlights the key marketing industry trends from Keen’s 2025 Report, backed by real data, so you can make better decisions.

Key highlights:

- Marketing industry insight #1: Budgets are rising, but efficiency is the real differentiator. Mid-market brands are leading with smarter media allocation and stronger returns, not just more spend.

- Marketing industry insight #2: The media mix is shifting toward search, streaming, and social. These channels are earning larger budget shares due to consistent performance.

- Marketing industry insight #3: Brands are moving top-of-funnel. Enterprise brands already prioritize awareness-building, and mid-market companies are following their lead to support long-term growth.

Top 6 trends for marketers for 2025

Before you start building next year’s plan, it’s worth stepping back to see what’s actually changing in the industry. Based on our analysis of 350+ brands, these are the current trends in the marketing industry:

Marketing industry trend #1: Budgets are rising, but smarter spending wins

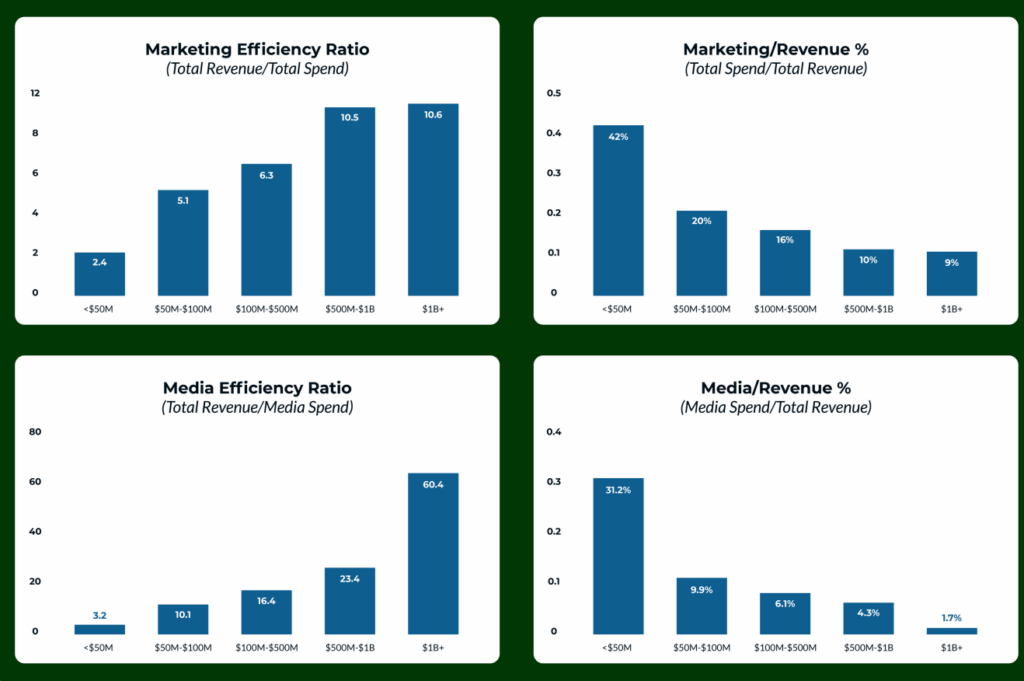

Marketing budgets went up in 2024. On average, brands increased their investments by 15%. But that only translated to a 4% boost in ROI. In other words, more spending isn’t the answer.

The data shows a clear pattern: companies that dial in their marketing channel mix and investment levels are seeing better returns. Media spend grew 16% and delivered the strongest ROI gains (+8%), while other areas, like trade promotions, lost efficiency.

Mid-market brands ($100M–$500M in revenue) are leading the way here. They’ve hit a marketing efficiency ratio of 16.4, well above smaller brands. That means they’re getting more revenue for every dollar they spend on media.

If you’re in the mid-market, this is your benchmark. Spend around 16% of revenue, and aim for that 16.4 efficiency mark.

Marketing industry trend #2: Search, streaming, and social are leading the media mix

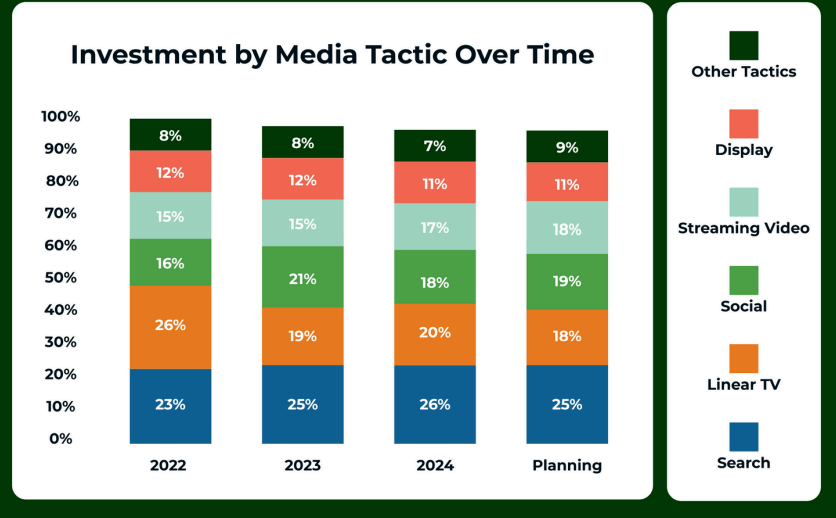

In 2024, brands focused their budgets on the channels delivering real results. Search came out on top, taking 26% of total spend. It consistently delivers high returns and remains a reliable performance driver across industries.

Streaming video and social media aren’t far behind. Together, they now account for 35% of budgets. That shift reflects where audiences are spending time, and where brands are seeing growing ROI.

Linear TV is still in the mix, holding a 20% share, but spending is slowly shifting toward streaming platforms like OTT and CTV. Brands are moving with their audiences, not away from them.

Here’s how the top media investments stack up:

- Search: Still a cornerstone, proven and scalable

- Streaming: Gaining ground as audiences move from traditional TV

- Social: A must-have for staying visible and relevant

- Display: A consistent performer with steady returns

If you haven’t revisited your media planning strategy lately, now’s the time. The most successful brands are prioritizing high-ROI channels and setting aside budget to test what’s next.

Marketing industry trend #3: Top-of-funnel spending is growing

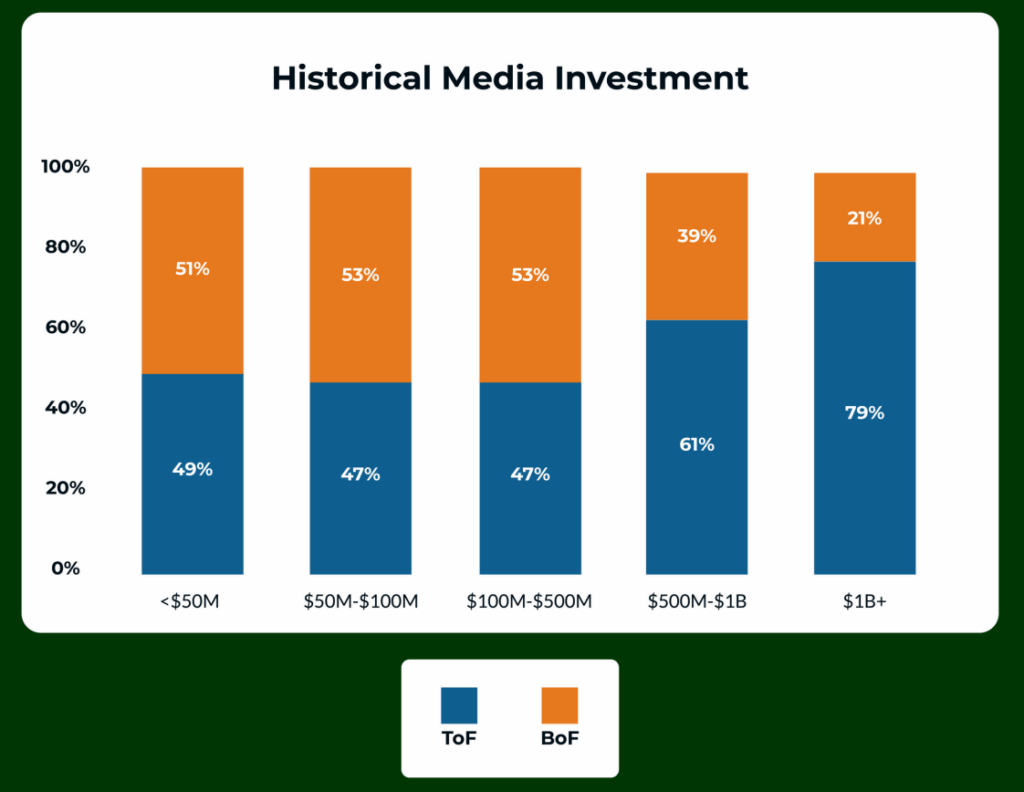

Brand-building is back in focus. In 2024, larger companies (over $500M in revenue) dedicated up to 79% of their budgets to top-of-funnel (TOFU) marketing. This is a clear shift toward long-term growth and brand equity.

Mid-market brands took a more balanced full-funnel optimization approach, splitting spend roughly 50/50 between the top and bottom of the funnel. But that’s changing fast. Many are now planning to push top-of-funnel investment up to 70%.

The reason is simple: stronger brands drive better results over time. And the data shows that TOFU activities—like streaming video, awareness campaigns, and social content—are pulling more weight in full-funnel marketing strategies.

If you’re currently performance-heavy, consider reallocating just 5% more toward top-of-funnel. Then track results quarter by quarter. This small shift can help you build brand visibility while still supporting conversions.

Read more: Performance marketing vs brand marketing: What’s the difference?

Marketing industry trend #4: mROI is the leading metric to measure

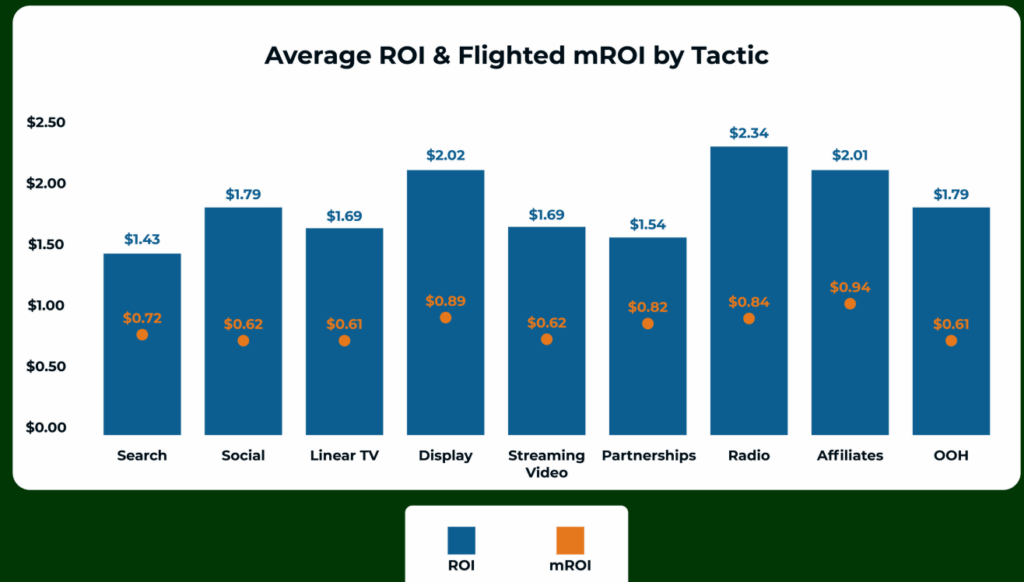

Knowing your marketing return on investment (ROI) is good. But knowing your marginal return on investment (mROI) is better. It tells you how much return you’ll get from the next dollar you spend, not just what you’ve gotten so far.

Keen’s analysis shows that a high overall ROI doesn’t always mean you should keep spending. In fact, many channels see diminishing returns as investment levels rise.

Take display ads: they show a strong average ROI of $2.02. But the mROI drops to $0.83, meaning that scaling beyond current levels may not be worth it.

Search performs similarly: high ROI, but with a noticeable gap between what’s already working and what more spending will yield.

The key is balance. Use ROI to identify strong channels, and mROI to understand how far you can scale them before returns flatten out.

Read more: ROI vs mROI: What’s the difference?

Marketing industry trend #5: Platform performance is shifting towards TikTok

In 2024, TikTok ad investment grew by 136%. It’s now one of the most cost-effective platforms, often delivering better efficiency than Meta in specific segments. Meanwhile, Meta’s budget share dropped from 11% to 8%.

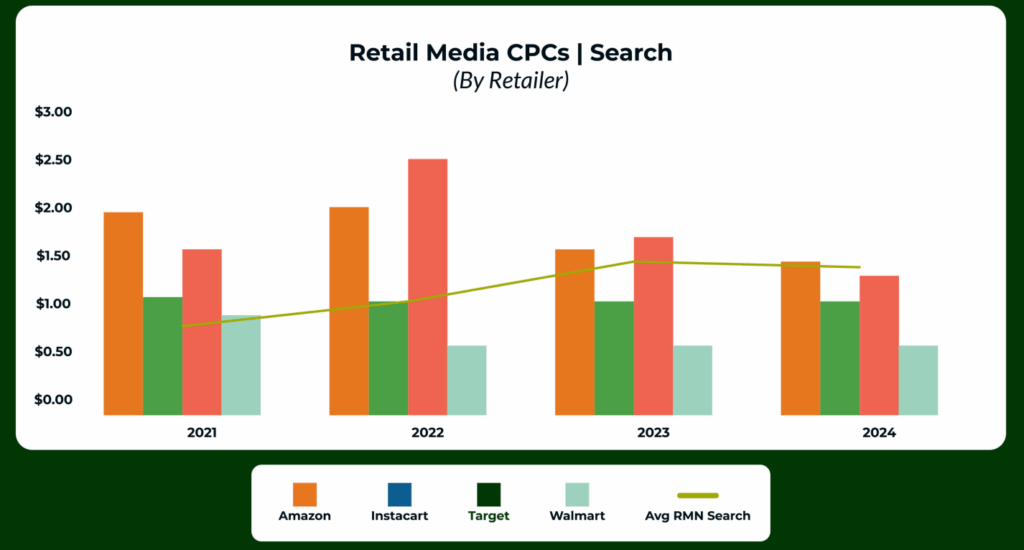

Retail media networks like Amazon, Target, and Walmart are also changing. While Amazon’s costs remain high, platforms like Target are gaining ground with more competitive pricing, especially in display.

What marketers are watching:

- TikTok: Lower costs, rising ROI, and rapid growth

- Meta: Still valuable, but reaching maturity

- Retail media: Growing fast, but pricing varies widely by platform

- Twitter/X: Ad spend declined 43% year over year

- Pinterest and Snapchat: Higher CPMs but with niche potential

Diversification is the smart move. Stick with what’s working, but test new platforms where the cost-per-click or CPM creates room for profit.

Marketing industry trend #6: Long-term brand impact is compounding

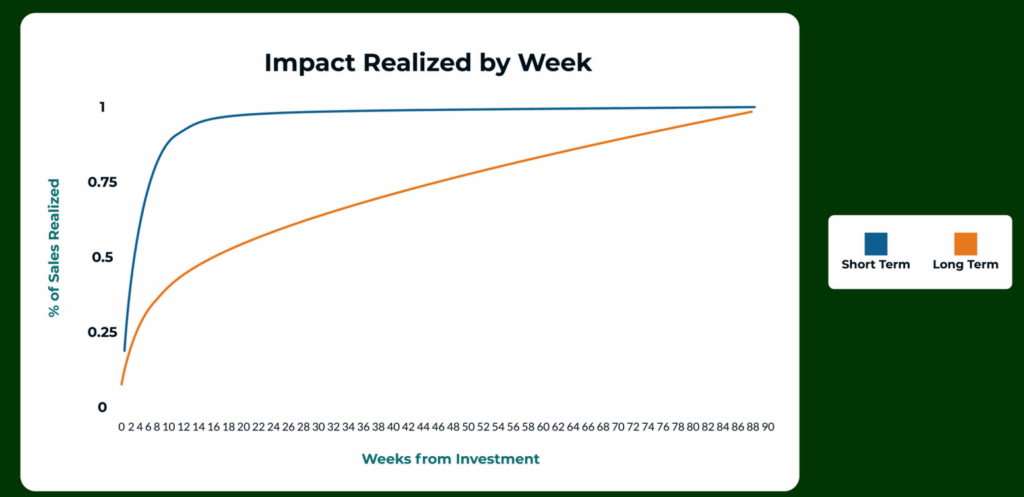

Marketing impact isn’t a one-and-done event. Keen’s data shows two clear performance curves: one for short-term results and one for long-term value.

Short-term campaigns hit fast. Around 90% of their impact shows up within 12–15 weeks. That’s useful when you need quick returns. But after that, gains level off.

Long-term campaigns grow steadily. They start slower but keep building, well past the one-year mark. In fact, the impact continues rising until around week 80, showing the compounding effect of sustained marketing.

The bottom line: you need both.

- Short-term efforts keep the engine running.

- Long-term efforts build the brand that makes your next campaign easier and cheaper.

If you’re only planning in quarters, you’re leaving long-term value on the table.

Rethink where your marketing budget goes in 2025

As marketing trends continue to shift, not all channels scale the same way. Some get more efficient with time. Others lose steam as costs rise or returns flatten. Keen’s 2024 data shows clear winners and areas to watch.

Streaming platforms like OTT and CTV are pulling ahead in video. They delivered the highest ROI in the category, outperforming both traditional TV and online video. YouTube is growing fast, too.

Social media remains a major player, but with nuance. TikTok is growing quickly and offers lower costs. Meta is steady but flat. Twitter/X saw a sharp drop in spend. And Snapchat is now the cheapest option by CPM.

Retail media is maturing. Amazon still commands top dollar, but Target and Walmart are gaining traction with better cost efficiency. Display costs are up, so it’s crucial to monitor mROI before scaling spend.

What to do next based on the digital marketing trends

Based on our analysis of the digital marketing industry trends, here’s what we’d recommend:

- Double down on streaming if video is a core part of your strategy.

- Test newer social platforms where costs are lower and engagement is strong.

- Watch retail media costs closely, especially if you’re using Amazon.

- Audit your current mix to shift spend toward channels showing high ROI and mROI.

Build your strategy using the latest marketing trends with Keen

Digital marketing trends are shifting faster than most teams can keep up. But the brands that outperform are the ones using real data to guide every decision. Keen’s MMM platform is built to do exactly that.

By measuring both ROI and mROI, analyzing channel decay curves, and benchmarking performance across 350+ brands, Keen helps you see what’s working, what’s not, and where to invest next.

Keen helps you lead your strategy backed by millions of data points. No matter if you’re recalibrating your media mix, shifting budget toward top-of-funnel, or deciding between TikTok and Meta, our platform can show you where you’ll get the best results.

Want the full breakdown of insights and trends for marketers? Download the 2025 Keen Marketing Insights Report.

Request a demo to see how Keen can help you leverage the current trends in the marketing industry.